Esprow launches ETP GEMS, the Global Exchanges and Markets Simulation Platform

ETP GEMS provides an on-demand testing environment to facilitate MiFID II compliance

New York, Singapore, London, 25 April, 2017 – Esprow Pte. Ltd., a global provider of enterprise testing

technology for the financial markets, announces the launch of ETP GEMS, its Global Exchanges and Markets

Simulation platform to enable market participants to test trading algorithms’ design and functionality, as well

as venue connectivity, and to comply with the latest MiFID II requirements.

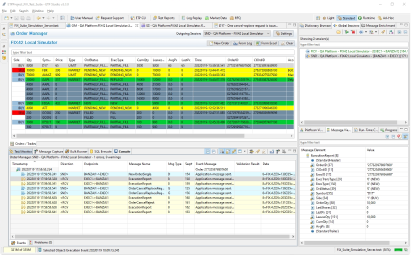

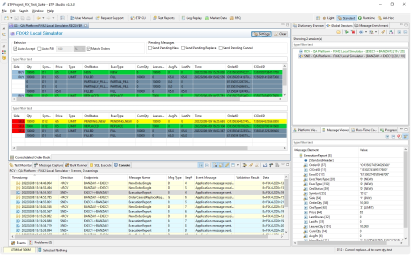

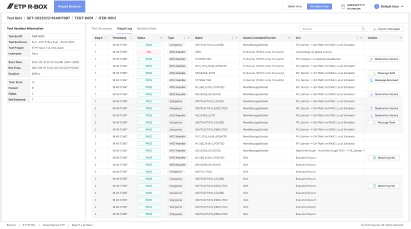

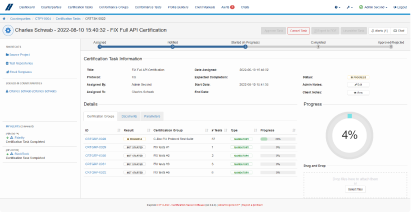

The latest MiFID II regulatory technical standards (RTS) require financial firms to test all algorithms and

certify connectivity with counterparties and trading venues, prior to market use. ETP GEMS allows brokers to

test trading algorithms independent of the trading venue, enabling them to carry out required MiFID II

assessments easily and efficiently. The service can also be deployed by exchanges as a service to their members,

to provide a global, secure, reliable and fully audited testing ground for market participants and partners.

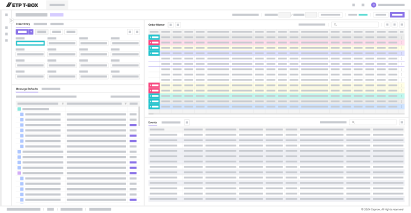

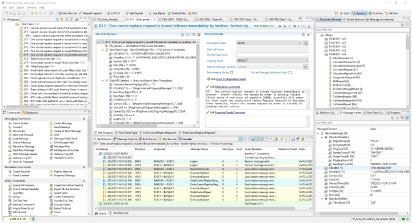

ETP GEMS is available on-cloud and on-premise, 24/7, which removes the current testing window limitation - as

most trading venues do not provide round-the-clock test environments. This restriction has required clients to

use valuable time and resources for test activities during open market hours, often while operating in different

time zones.

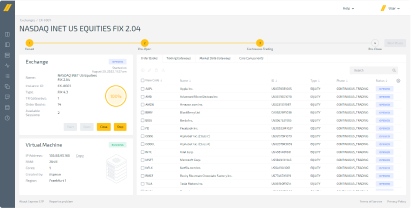

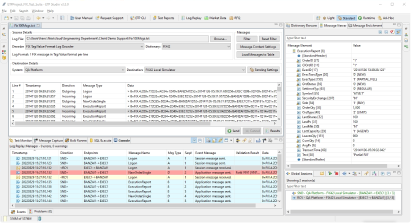

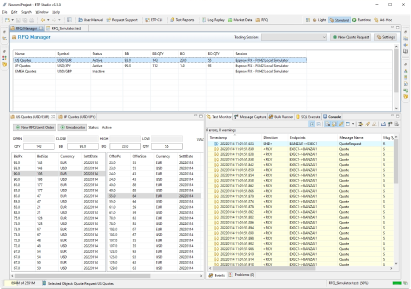

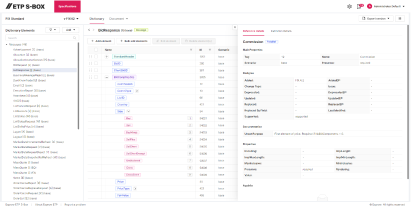

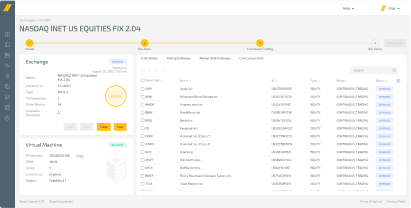

The platform can be deployed across the business, providing scalability and security. ETP GEMS provides multiple

trading functionality such as the option of accessing multiple order books, replaying synthetic and historic

market data and controlling trading behavior, including market auctions and race conditions.

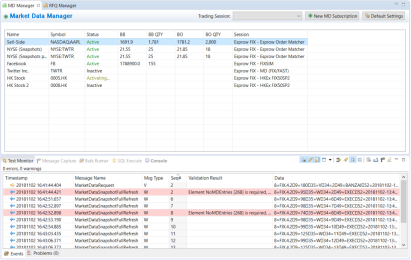

Esprow ETP GEMS provides matching engine functionality and native trading connectivity which exchanges can offer

to all their members to facilitate their connectivity and conformance testing. It currently supports a number of

Asian exchanges – including Hong Kong and Tokyo - and many FIX exchanges, and will add multiple US exchanges

later in the year.

Francesco Lo Conte, Managing Director at Esprow said: “ETP GEMS is the first of its kind – a high-fidelity

exchange simulation platform covering global markets. ETP GEMS has been developed in cooperation with market

participants. Our platform allows brokers to comply with MiFID II regulations when testing their connectivity

and algorithms, and provides them with a 24/7 testing environment that was not previously available.” He added

“We are also delighted that ETP GEMS will enable exchanges themselves to provide an important, on-demand

algorithm testing solution for their members."

Media contact

Melanie Budden

The Realization Group

Tel: +44 (0)7974 937970

Email:

About Esprow

Esprow is a global technology firm specializing in automated testing, on-boarding and simulation solutions for

the financial services community. Esprow provides implementation, customization, integration, training and

professional services for its Enterprise Testing Platform suite of products.

About Esprow’s Enterprise Testing Platform (Esprow ETP)

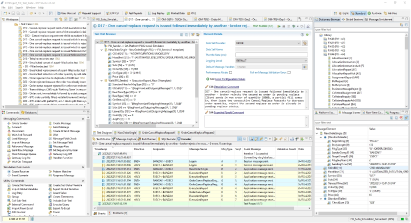

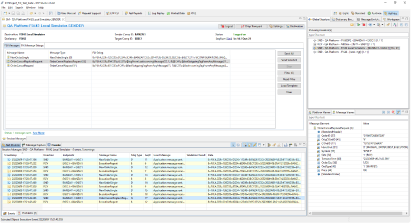

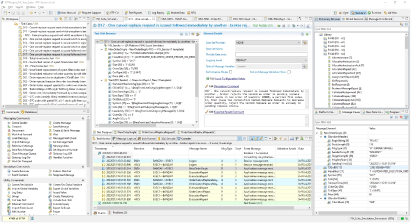

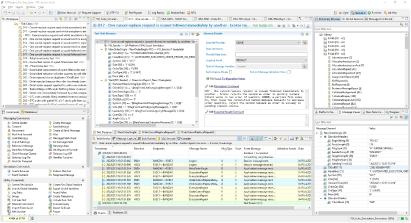

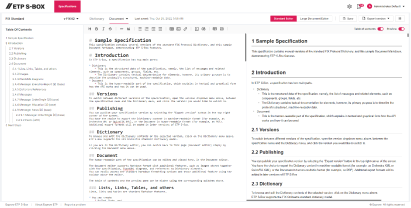

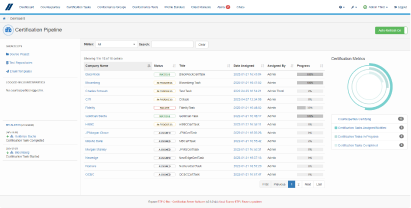

Esprow ETP automates testing, simulation and certification of trading components across a wide range of financial

messaging protocols, including FIX. Launched in 2012, Esprow ETP is an integrated testing framework that

addresses the requirements and challenges of the development, QA and risk management departments. ETP is quickly

grabbing the attention of the industry’s most forward-looking players aiming to automate testing, reduce

technology risk, and comply with global regulations for testing of trading systems and algorithmic trading

strategies.

For further information, please contact:

Esprow Sales Team

Tel: +1 (347)-255-7798

Email:

For more information about Esprow and Esprow ETP, visit www.esprow.com

.png)